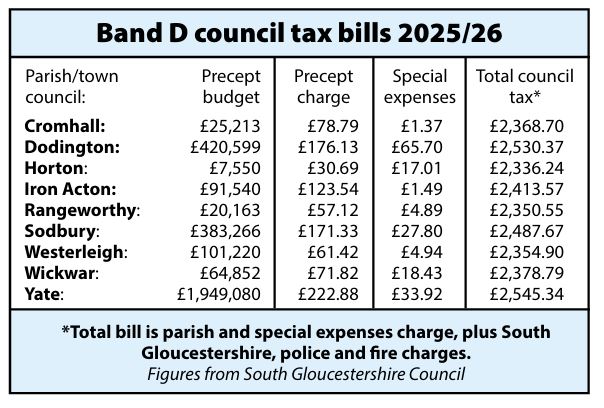

THE average council tax bill for Yate residents will be more than £2,500 for the first time this year.

People living in average Band D homes in areas covered by Yate Town Council and Dodington Parish Council will pass the milestone figure due to a combination of tax rises from public bodies.

Residents who live within the borders of Sodbury Town Council will see their bills stay just under £2,500 in Band D, with bills across the area rising by between £110 and £153 in Band D.

When the increases in charges from South Gloucestershire Council, parish councils, the police and fire services are added up, Band D householders living within the area covered by Yate Town Council are set to pay an extra £121.50 or 5.01% this year, with their total bill now £2,545.34 – passing £2,500 for the first time.

Charges vary according to property values, with this year’s overall charge in Yate ranging from £1,696.90 for Band A householders to £5,090.68 for people with homes in Band H.

South Gloucestershire Council charge

South Gloucestershire Council approved a 4.99% increase – the maximum allowed without calling a referendum – at its meeting in February, to take the authority’s main charge to residents with homes in the average Band D tax bracket up by £90.54, from £1,814.37 to £1,904.91.

The council also makes a separate ‘special expenses’ charge, which varies between parishes, for neighbourhood services, such as parks and open spaces that it maintains.

The rest of the increase in overall bills comes from other public bodies.

Police and fire charges

Avon & Somerset police and crime commissioner Clare Moody is raising charges for a Band D tax payer by £14 (5.01%), from £279.20 to £293.20.

Avon Fire Authority is raising its annual charge by £5 or 5.85%, from £85.43 to £90.43, in Band D.

However the final amount paid by people living in different areas also varies because of precept charges for services provided by parish councils, which do not have a government-imposed cap on increases.

Highest bill is in Yate

In the Yate and Sodbury area, Yate Town Council has the highest precept budget and charge, to pay for the buildings, parks and services it maintains, and as a result the overall Band D council tax bill is higher than in neighbouring parishes.

Yate’s £222.88 Band D precept charge is up £10.01 or 4.7% on last year – and the £33.92 special expenses charge for local services provided by South Gloucestershire is up £1.95 or 6.1%.

The overall parish precept budget is going up by £125,812 or 6.9%, from £1,823,268 to £1,949,080.

Dodington parish charge up by 28.1%

Dodington Parish Council, which covers southern parts of Yate and Sodbury, is responsible for the biggest precept rise in the area this year: it is raising its Band D charge by £38.63 or 28.1%, from £137.50 to £176.13.

Its precept budget is going up from £328,905 to £420,599, a rise of £91,694 or 27.9%. Another £65.70 in special expenses – a £4.77 (7.83%) increase – is also added to the bill.

It means the overall Band D charge for taxpayers in Dodington has risen by £152.94 (6.43%) to £2,530.37, making it the second parish in the area to pass the £2,500 mark.

Sodbury parish charge up by 21/2%

Sodbury Town Council has raised its Band D charge by £30 or 21.2%, from £141.33 to £171.33.

Its budget is up by 23.7% or £73,470, to £383,266.

Special expenses are up by £1.58 (6.02%) to £27.80, and the total bill for Sodbury Band D taxpayers will be £2,487.67, up £141.12 (6.01%) on last year.

Westerleigh & Coalpit Heath Parish Council has raised its Band D precept by just 68p (1.12%), from £60.74 to £61.42. Its overall precept budget is up by £3,250 (3.32%).

Special expenses are up by 5p (1.02%) to £4.94, and the overall increase for Band D taxpayers is £110.27, up 4.91%.

For residents of Iron Acton, total Band D bills are up by £117.91 or 5.14%, to £2,413.57.

Iron Acton Parish Council has raised its Band D precept by £8.32 (7.22%) to £123.54, with special expenses up by 5p (3.47%) to £1.49.

The parish council’s overall budget has risen by £9,620 or 11.7%.

Rangeworthy has the lowest increase in overall Band D bills, which are up by £110.12 or 4.92%.

Band D precept charges are up by 43p (0.76%), and special expenses up 15p (3.16%), with the parish budget up by £1,003 (5.23%) – an increase in the number of homes paying council tax means the rise is lower per household.

Elsewhere, variations in parish and special expenses charges mean total bills are up by £111.31 (4.93%) in Cromhall, £113.85 (5.12%) in Horton, and £115.39 (5.1%) in Wickwar.

The highest council tax bills in South Gloucestershire are in Filton, where the parish council’s Band D precept charge is £312.33, and total bills are £2,610.75.